Get the free uz 4 form pdf

Show details

The law changed the process back to the way it operated prior to July 15 2006. The changes permit any duly certified qualified UEZ business to claim a sales tax exemption at the point of purchase for eligible exempt purchases of tangible personal property and services that are used or consumed exclusively at the UEZ business location when an Urban Enterprise Zone Exempt Purchase Certificate Form UZ-5 is issued to its sellers. NOTICE URBAN ENTERPRISE ZONES REFUND PROCEDURES REVISED February 10...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your uz 4 form pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uz 4 form pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit uz 4 form pdf online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit uz 4 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

How to fill out uz 4 form pdf

How to fill out uz 4?

01

Obtain a copy of the uz 4 form from your local government or online.

02

Read the instructions carefully to understand the requirements and necessary information.

03

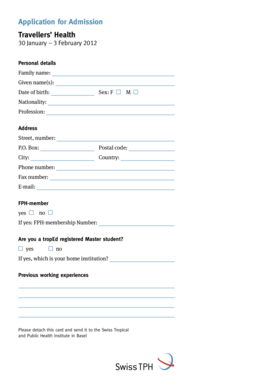

Begin by providing your personal details such as name, address, and contact information.

04

Fill in your employment information, including your current job title, employer, and salary details.

05

Provide any additional income details, such as investment income or rental income.

06

Fill out the section for deductions and allowances, including any dependents or tax credits you are eligible for.

07

Calculate your total income and deductions accurately and enter the final amount.

08

Sign and date the uz 4 form, attesting that the information provided is true and accurate.

09

Submit the completed form to the designated government office either in person or by mail.

Who needs uz 4?

01

Employees who receive income from their employer.

02

Individuals with multiple sources of income, such as rental properties or investments.

03

Anyone eligible for deductions or tax credits, such as parents with dependent children or homeowners with mortgage interest deductions.

04

Self-employed individuals who need to report their income and expenses for tax purposes.

05

Anyone required by law to file an annual tax return and report their income accurately.

Fill new jersey uez forms : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is uz 4?

"uz 4" does not have a specific meaning or context. Without further information, it is not possible to determine what it refers to.

Who is required to file uz 4?

Form UZ-4 is usually filed by employers to report wages and taxes for each employee who worked in a jurisdiction during a specific period. The specific requirements for filing Form UZ-4 may vary based on local tax regulations, so it is advisable to consult with local authorities or tax professionals to determine who exactly is required to file Form UZ-4 in a particular jurisdiction.

How to fill out uz 4?

To fill out Form UZ-4, you will need the following information and steps:

1. Personal Information: Provide your full name, social security number, address, and contact information.

2. Employer Information: Enter the name, address, and federal employer identification number (FEIN) of your employer.

3. Employment Details: Specify your job title, hire date, and work location.

4. Salary and Tax Information: Report your gross wages or salary earned during the reporting period and the corresponding federal income tax withheld. Include any local or state income tax withheld as well, if applicable.

5. Other Deductions: List any additional deductions made from your salary, such as retirement contributions or health insurance premiums.

6. Signature: Sign and date the form to certify that the information provided is true and complete to the best of your knowledge.

Note: The exact instructions and requirements may vary depending on the specific jurisdiction or organization requesting the form. It is advisable to consult the associated guidelines or consult a tax professional if you have any doubts or questions while completing Form UZ-4.

What is the purpose of uz 4?

As of my knowledge, there is no specific reference to "uz 4" in any context or domain. It could be a product, a term, or an abbreviation that is not widely known or recognized. Therefore, it is difficult to determine the purpose or meaning of "uz 4" without additional information.

How can I send uz 4 form pdf to be eSigned by others?

When your uz 4 form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I edit nj uz 4 form on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing nj uz4 form right away.

Can I edit urban enterprise zone exempt certificate uz 5 on an Android device?

You can make any changes to PDF files, such as blank uz 4 form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your uz 4 form pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nj Uz 4 Form is not the form you're looking for?Search for another form here.

Keywords relevant to nj uz 5 form

Related to nj division of taxation form uz 4

If you believe that this page should be taken down, please follow our DMCA take down process

here

.